For a long time, cricket remained the undisputed leader of the Asian sports industry. Tournaments such as the IPL, Asia Cup, and ICC championships attracted millions of viewers, creating entire economies around a single game. In India, Pakistan, Bangladesh, and Sri Lanka, cricket has become more than just a sport; it is part of the national identity, comparable to religion. However, with the start of the 2020s, this monopoly began to crack.

The emergence of young viewers with new media consumption habits, the growing popularity of American leagues, and the expansion of global brands have led to a rapid increase in interest in basketball, especially the NBA. Mobile apps, digital broadcasts, and prediction and betting platforms have played a key role in this process. For example, 1xBet NBA is already seeing steady growth in user activity during the playoffs and drafts. This is an indicator of a change not only in interests but also in the style of sports consumption.

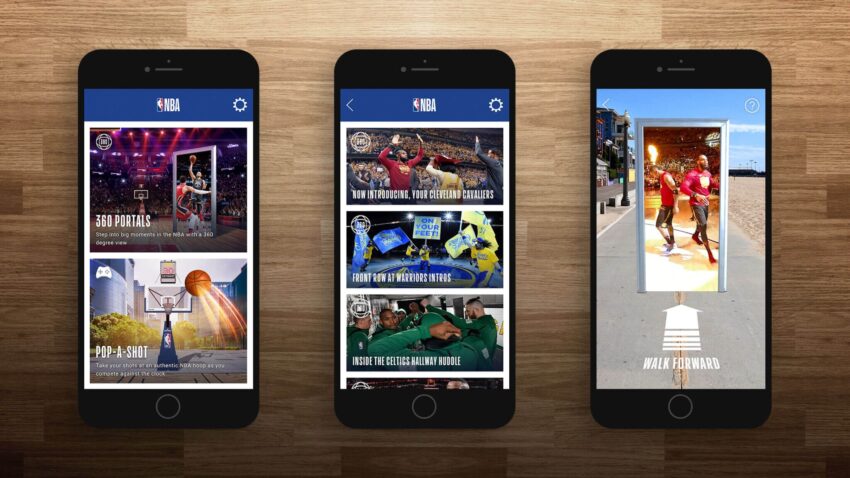

Basketball is becoming increasingly integrated into the local context: in India through the NBA India Academy and partnerships with Reliance, in the Philippines through university leagues, and in Indonesia through grassroots programs. This is no longer just an import of content, but a transformation of fan culture. Sports fan engagement, digital match-day experience and interactive fandom are key elements of the new stage of the industry's development.

Fan behavior: from obsession to participation

Sports consumption in Asia is changing at a remarkable pace. Whereas cricket fans used to be associated with passive viewing and spontaneous emotions, today's fans are active participants. They follow statistics, participate in fantasy leagues, subscribe to analyst and streamer channels, produce their own content, and place bets in real time.

Interactive fandom has become a key trend in recent years. For cricket, this is reflected in the growth of IPL team followers, engagement through Instagram Stories and challenges, and the huge popularity of fantasy platforms such as Dream11. Fans don't just watch the game — they make predictions, assemble teams, share their emotions in Telegram chats, and watch replays on their own schedule.

Basketball, on the other hand, offers a different type of engagement. Unlike the pompous IPL show, the NBA builds long-term communication. The NBA India channels on YouTube and Instagram actively talk about players, cover behind-the-scenes action, and host AMA sessions and live chats with commentators. This creates emotional fan bonding — attachment not only to the team, but also to the players, coaches, and moments.

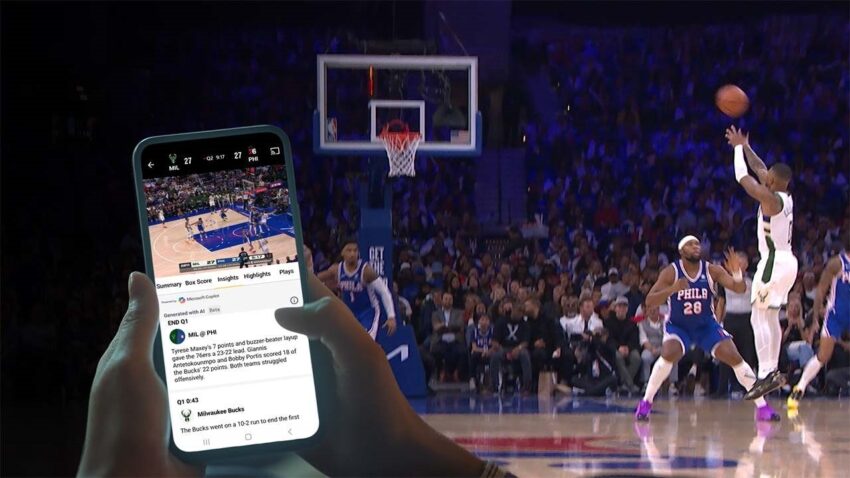

Young viewers, especially Gen Z, are used to gamified, mobile, and social content. They are less likely to watch a full game and more likely to watch highlights, funny clips, vote for the MVP, and create memes. Their interest is focused on dynamics, personalization, and the opportunity to participate. As a result, even traditional formats are adapting to fan-driven content — for example, the NBA publishes “hot” moments based on geolocation, and cricket streaming services launch polls among viewers during breaks.

It is important to note that focusing on the mobile experience is not just about viewing. It is about participation. Users feel like they are part of the game, especially when they have the opportunity to influence it, even indirectly, through likes, predictions, bets, and discussions.

In this way, fans become not just an audience, but co-creators of the sports product. Their engagement is no longer measured by the number of views, but by their activity: how many minutes they spend in the app, how many reactions they make, how many decisions they make during a match. This is the new asset of the industry, which works for both cricket and basketball.

Betting and engagement: cricket leads the way, but the NBA is catching up

Sports betting has long ceased to be a niche hobby. In South and Southeast Asia, it is becoming part of the digital fan experience. And while cricket used to be the absolute leader here, today there is a shift — interest in basketball is growing, especially in NBA games.

Platforms are recording a steady increase in user engagement with games involving top NBA teams. Live predictions and bets on individual statistics are particularly popular:

- number of three-pointers;

- number of rebounds;

- total assists.

Particularly high activity is observed during the playoffs, All-Star Game, and draft.

As for cricket, it remains the leader in the categories of long-term bets, tournament winners, and first serves. However, it is basketball that is increasingly attracting those who want flexible, instant, and personalized betting. Players react to the moment, not the entire match.

This reflects a general shift in sports betting trends: users care not only about the probability of winning, but also about the experience itself. This turns betting into part of the show — especially when it is integrated into the match interface rather than existing separately. Basketball wagering wins out thanks to its speed and visual richness — cross-platform apps allow you to bet without taking your eyes off the game, with just one tap.

This development confirms that betting is no longer just an additional option, but a way to deepen the fan experience. Both cricket and basketball are responding to this by integrating game mechanics into their mobile apps, creating visual dashboards and personalized offers.

Mobile platforms and streaming: changing screens and formats

One of the key factors transforming the fan experience is the change in screen. Young people are increasingly watching sports on their smartphones rather than on TV. This conclusion has been reached by The Philippine Star and a number of other publications. This applies to both the IPL and the NBA, with basketball often winning out in terms of its suitability for the mobile format: short quarters, fast pace, predictable match structure.

In Asian countries, the most popular platforms are:

- JioCinema (cricket);

- NBA App;

- YouTube (basketball);

- as well as local OTT services with exclusive broadcasts.

This creates competition not for rights, but for user attention. And here, those who focus on mobile-first sports consumption come out on top.

The NBA actively uses mobile channels: push notifications, vertical video clips, and personalized notifications for selected players. Cricket teams in the IPL are not far behind — they create memes, release backstage content, and broadcast emotions on social media. This is no longer broadcasting, but sports content streaming with a fan focus.

It is also important that video formats are becoming increasingly flexible. Users don't have to wait for the evening match — they get fan-driven video formats: instant highlights, real-time statistics, and personalized compilations. This makes sports closer, more dynamic, and more personal.

Thus, mobile platforms have become the arena where cricket and basketball compete for attention. And it is not the loudest who wins, but the one who responds fastest to the interests of the audience.

Can a developing country create a competitive basketball league?

While cricket continues to dominate in Asia, growing interest in basketball raises an important question: can developing countries create a sustainable and competitive basketball league capable of rivaling international brands? The Daily Excelsior portal writes about this, analyzing the obstacles and prospects.

The key challenges are obvious:

- lack of infrastructure;

- lack of media support;

- poor training and limited funding.

By comparison, in India, the annual budget of the IPL (cricket) exceeds $600 million, while any basketball league, such as the UBA (United Basketball Alliance), struggles to stay afloat with a fraction of that amount.

However, interest from young audiences and global brands, including the NBA, has already laid the groundwork. Grassroots programs are emerging in India, the Philippines, and Indonesia, youth academies are opening, and partnerships with broadcasters are being established. This is what can lay the foundation for future growth.

To assess the feasibility of creating a sustainable basketball league in a developing economy, let's compare key parameters with cricket:

Comparison of the conditions for the development of cricket and basketball in Asian countries:

| Parameter | Cricket (IPL, PSL) | Basketball (UBA, amateur leagues) |

| Historical background | Deeply rooted | Relatively new |

| Infrastructure (stadiums, arenas) | Well developed, supported by the state | Insufficient, being developed locally |

| Television rights | Highly competitive, expensive contracts | Limited broadcasting, low market share |

| Investor attraction | High, world-class sponsors | Local brands, limited participation |

| Fan support | Massive, stable | Fast growing but unstable |

| International integration | ICC, World Cup | Support from the NBA, but no own uniforms |

You can see that basketball does not have the same structural advantages as cricket. However, it wins in other areas: flexibility of formats, high visual appeal, quick adaptation to mobile platforms, and global recognition.

The Daily Excelsior's conclusion is logical: for basketball to become mainstream and sustainable in developing countries, it must be built with the local context in mind — through education, localization, digital media, and fan engagement. And global players such as the NBA and streaming services can accelerate this process by investing in fan bases and infrastructure from the bottom up.